With the 2010 results out of the way, my attention turns to MGM's multi-year turnaround story. After the company's financial performance suffered during the recession of 2008 and 2009 and its aftermath, MGM is experiencing some problems, but now showing positive signs for future growth.

With only $1 billion of annual EBITDA, MGM has a free cash flow problem. Annual CapEx is in the $200-$300 million range. Furthermore, MGM has $11.5 billion of net debt, plus 50% of the CityCenter and MGM Macau of approximately $2 billion. Its interest expense for 2010 was $1.1 billion, excluding interest at CityCenter.

However, MGM is in the process of a turnaround and its EBITDA should grow from $1 billion back up to the pre-crisis range of $2 billion. EBITDA growth will be driven mainly by an improving economy, which will bring vacation and convention visitors back to Las Vegas. Given MGM's operational and financial leverage, the company is an attractive play on the rebounding economy.

Furthermore, MGM launched two new operations since the last peak that should generate significant EBITDA and shareholder value. In late 2009, MGM launched CityCenter, a mammoth new casino and resort project in Las Vegas. CityCenter generated $840 million of revenue and $70 million of EBITDA in 2010, its first year of operations. When it reaches its full potential, it should generate over $1 billion of revenue with a >25% EBITDA margin (Bellagio alone generated over $1 billion of revenue and $270 million of EBITDA in 2010). Additionally, MGM is in the process of doing an IPO for MGM Macau, which should generate shareholder value in the short term.

Importantly, on the recent conference call MGM's management gave positive guidance and expectations for 2011. The following are a few quotes from the call:

Positives

- Visitor Growth (I) - "Visitor growth was about 3%, and for [2011] the LVCVA is predicting another 3% increase. We think there is upside to those numbers based on increased scheduled flights into Las Vegas, a stronger convention calendar, and the early booking pace that we are seeing already this year, particularly in the year for the year."

- Visitor Growth (II) - "On the Casino side, we continue to see strength in the international play. In fact, we had another all-time record in the city and for our Strip properties in 2010 including ARIA in terms of international volume."

- Visitor Growth (III) - "We're in the tail end of Chinese New Years and we've seen very strong volumes here in Las Vegas. In fact, in one metric we're looking at -- we flew about 15% more customers into Las Vegas this year than last, all of our suite product has been fully occupied through the whole period with high-volume and high-value guests."

- Conventions - "Looking at it for the full year, we have approximately 1.6 million convention room nights on the books [NOTE: MGM has ~12 million annual room nights] which is a double digit increase from the same time leading into last year. And we're still seeing strong bookings, as I said, for in-the-year, for-the-year."

- RevPAR (I) - "And the convention mix helps us drive much better revenue, and reason why we believe REVPAR will be up all year in 2011 for our company."

- RevPAR (II) - "Our strip REVPAR in the quarter was down 2% excluding resort fees. Had we included resort fees in the quarter, our REVPAR would have been up approximately 2% in the quarter."

- RevPAR (III) - "Beginning in the first quarter, we will be including resort revenue which is a change for us in our hotel revenues, ADRs and REVPAR to be consistent with industry practice, and to give you a sense for where we are forecasting our REVPAR for the first quarter, we believe that REVPAR will be up at least 10% in the first quarter including resort fees."

- RevPAR (IV) - "I don't think, for example, we could have deployed the resort fee strategy two years ago and be as successful as we are right now. That effectively is a price increase and it has been very well-received and has had a big impact on revenue for us and will this year."

- Spend - "One area that was challenging last year is customer spend, though even there, we're seeing some improvements at least in the luxury segments. We're beginning to see convention customers actually renting out some of our other amenities like nightclubs and restaurants and the Beach at Mandalay Bay and even the MGM Grand Garden. That has not occurred since back in 2008. In addition, we see that improved customer spend around our other special events like fights and concerts and holidays, which also bodes well for improvement this year."

On the positive side, MGM is expecting over 3% growth in visitors to Las Vegas and, as the largest hotel and casino company in Las Vegas, MGM should experience a similar increase. Not only will visitation increase, but conventions bookings are up, which is a boost to both occupancy and rates. Furthermore, MGM has seen an increase in RevPAR, due, in part, to the launch of its resort fee, which is effectively a price increase.

In a recent investor presentation from February 16, 2010, MGM explained its operating leverage and how such increases translate into EBITDA. Assuming 90% occupancy:

- 1% increase in occupancy = Approximately $40 million of EBITDA

- $1 incremental rate increase = Approximately $10 million EBITDA

- $5 increase in RevPOR = $40 million EBITDA

Therefore, a 3% increase in occupancy could generate an additional $120 million of EBITDA. A 10% increase in RevPAR could generate another $100 million of EBITDA (RevPAR is in the $50-$200 million range depending on the property, so a 10% increase on $100 of RevPAR would generate an additional $10 of RevPAR, which translates into $100 million of EBITDA). The rate increase would likely happen gradually over the year, so the final result may be a bit less.

These are rough estimates, but based on management's projections, MGM could add $200 million of EBITDA in 2011, before additional increase in EBITDA from CityCenter and MGM Macau. So, 2011 EBITDA could reach at least $1.2 billion and likely higher (over 20% growth y-o-y). I believe that over the next 3-5 years, EBITDA will continue to grow and approach $2 billion.

MGM's balance sheet and valuation still remain an issue. Currently, the company has $11.5 billion of net debt, plus approximately $1 billion of its share of off-balance sheet debt (mostly from CityCenter and MGM Macau). With $1 billion of EBITDA, the company is not generating enough free cash flow to pay down debt because interest expense is over $1 billion annually and CapEx is in the $200-$300 million range. However, if MGM reached $1.2 billion of EBITDA in 2011, I expect it to be in a position to generate free cash flow to pay down debt in 1-2 years. Having restructured its balance sheet in 2010 (and CityCenter's balance sheet), it is not facing near term debt maturities and has time to grow its free cash flow.

Furthermore, MGM has two short term liquidity opportunities. It is in the process of selling its share of the Borgata in Atlantic City. Already, the trust controlling MGM's Atlantic City holdings has almost $200 million and the amount will increase with the proceeds of the Borgata sale. In total, MGM should receive a few hundred million from Atlantic City. Additionally, the IPO of MGM Macau should generate some liquidity for MGM Macau and potentially MGM.

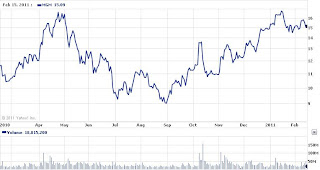

Still, valuation remains an issue. The stock is trading at approximately $14 per share. With 489 million shares, the market capitalization is $6.8 billion. Add to that $12.5 billion of net debt (including off balance sheet), the TEV is $19.3 billion, which equals 19.3x 2010 EBITDA of $1 billion and 16.1x EBITDA of $1.2 billion.

However, assuming MGM can generate $1.5 billion of EBITDA, which should be achievable in 2012/2013 and a 13x multiple and pay down $1 billion of net debt, the shares should trade up to approximately $16.50 (18% increase).

Looking further into the future (3-5 years), MGM could generate $2 billion of EBITDA and reduce net debt to $10 billion. In this case, even a 12x TEV / EBITDA multiple would generate a stock price of $28.50, which is 2x the current share price.

MGM continues to face challenges, but over time its performance should improve. Any improvement will be highly sensitive to the general economy, for better and for worse. MGM's operational and financial leverage provide an attractive play on the economic recovery with a potential for a 2x return in 3-5 years.