Welcome to the Soha blog. I am launching this blog to add another layer to my investing process for the portfolio that I established two years ago. In general, I write detailed reports on the companies that I invest in, but also want to write about these companies on a less formal and ongoing basis. Over time I will incorporate more of my detailed analysis in this blog, but I am beginning with a general overview of my current portfolio.

Blueknight Energy Partners (BKEP)

Blueknight is my largest position, representing 19% of the portfolio. The company is a midstream oil and gas company that operated pipelines and storage facilities, mainly in Cushing, Oklahoma. Blueknigh is undergoing a recapitalization after experiencing several changes in the past two years. Blueknight was formed as a public subsidiary of Semgroup LP with the intention of Semgroup dropping down assets into Blueknight. However, when Semgroup LP filed for bankruptcy, it lost control of Blueknight's GP. These events led Blueknight to a technical default on its credit agreements and the loss of significant revenue generated by agreements with Semgroup LP. More recently, Vitol acquired Blueknight's GP and the company has been working on stabilizing its business. In late 2010, Vitol sold half of the GP to Charlesbank, a private equity fund, and together with Charlesbank proposed a series of recapitalization transactions. The terms of the recapitalization were contested by three funds that own approximately 40% of the common units on the grounds that the deal was unfair to the common unit holders. I fully agree with this view. My investment thesis is based on the company completing its recapitalization, on modified terms, and continuing to improve its business to regain lost revenue.

Proshares Short S&P 500 (SH)

My second largest position is an inverse (or short) ETF on the S&P 500. This position represents 16% of the portfolio.

Makhteshim Agan Industries (MAIXF)

Makhetshim Agan is an Israeli producer of generic crop protection products. This position represents 12% of the portfolio. The company recently received an offer to take the company private for approximately NIS 20 per share, which translates into $5.43 per share based on the current exchange rate. The deal is expected to close in one or two quarters. Given the uncertainty regarding the deal (the price was already reduced once) and the uncertainty in the exchange rate, I am looking to sell the shares at a small discount to $5.43; however, with the stock at $5.01, the discount is too large and I am waiting for the stock to reach the $5.20 range.

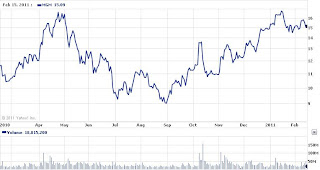

Macquarie Infrastructure Company (MIC)

Macquarie Infrastructure Company, which represents 10% of the portfolio, is a listed infrastructure fund. MIC has emerged from the troubles it had during the financial crisis in 2008/2009 when it was caught with too much debt and a cyclical downturn in its aviation services business as air travel volumes declined. However, the company has benefited from strength in its oil storage business. When the downturn began, the company suspended its distribution; however, I expect the company to resume distributions, at lower levels, in the next one to two quarters. The ongoing deleveraging, resumption of distributions and growth of the distributions as the aviation services business continues to rebound will provide catalysts for the stock. Importantly, the resumption of the dividend should bring back investors that look at MIC as a yield play, which are an important constituency for infrastructure stocks.

Semgroup Corp (SEMG)

Semgroup Corp, a midstream oil and gas company that recently emerged from bankruptcy, represents 10% of the portfolio. As mentioned above, Semgroup Corp (formerly, Semgroup LP) filed for bankruptcy two years ago. The bankruptcy was triggered by the trading activities of the management team, which has since been replaced. Semgroup primarily is a midstream oil and gas company and trading was never a core part of its operations. The company emerged from bankruptcy and began trading in November 2010. I believe that the company was priced at an attractive level when it emerged from bankruptcy. Post bankruptcy companies are often under-priced and under-followed, which can create opportunities for gains.

MGM Resorts International (MGM)

The Las Vegas casino operator, MGM, represents 9% of the portfolio. MGM's business is correlated to the general economy and is not immune from recessions, as casinos may have been in the past. MGM is the largest casino operator in Las Vegas and its financial performance declined significantly during the recent recession as fewer visitors vacationed in Las Vegas and businesses cut back on convention spending. Furthermore, MGM is highly leveraged and faced liquidity issues. At this point, MGM's balance sheet is improved after debt recapitalizations, equity fundraising and asset sales. Although management has cut expenses significantly, its EBITDA for 2011 is projected to be 62% of peak EBITDA in 2006. However, at this point in the cycle, MGM looks attractive. The economic recovery has begun and trends in Las Vegas are less negative than in the past two years and are starting to turn positive. Furthermore, after a period of significant new construction in Las Vegas, including by MGM with its CityCenter project, hotel room capacity growth has slowed significantly, which should be a positive for the existing players in Las Vegas, especially MGM. The investment thesis is based on a cyclical uptrend of the next couple of years which should increase EBITDA to pre-recession levels. The high leverage will benefit shareholders as the company's performance improves.

General Motors Preferred (GMPRB)

When General Motors went public in 2010 after emerging from bankruptcy it issues preferred stock in addition to common stock. The portfolio's position in GMPRB represents 9% of the total and I established this position shortly after GM's IPO. The preferred shares are convertible into common and provide downside protection while also offering a dividend. Based on my purchase price, the yield is greater than 4%. GM is a play on an improving domestic economy and the company's strong position in the Chinese market. Furthermore, I suspect that the IPO was a bit underpriced because of the large offer size, messy history and the government's desire to sell more in the aftermarket. The GM preferreds provide a less risky way to play GM's upside and possible IPO underpricing.

Diana Containerships (DCIX)

Diana Containerships was recently formed through a spinout from Diana Shipping (DSX). I established the position in Diana Containerships after the spinout and it represents 6% of the portfolio. Diana Containerships owns 2 containerships and intends to purchase additional vessels. Diana Containerships is managed by the same team that manages Diana Shipping. The management team is experienced, conservative and prudent and made appropriate decisions through the ups and downs of the dry bulk cycle. Diana Containerships is a play on the recovering trends in the containership market (which are more promising than the dry bulk market) and management's ability to make prudent acquisitions. Furthermore, currently the stock is trading at approximately a 10% discount to the NAV of its vessels (which were acquired as newbuilds in mid 2010) and pricing has come down from previous highs, so the downside in the stock should be limited.

Cash

The portfolio has 8% of its value in cash.

DISCLOSURE: I AM LONG BKEP, SH, MAIXF, MIC, SEMG, MGM, GMPRB, DCIX.

No comments:

Post a Comment